Capitalism’s Increasing Failure

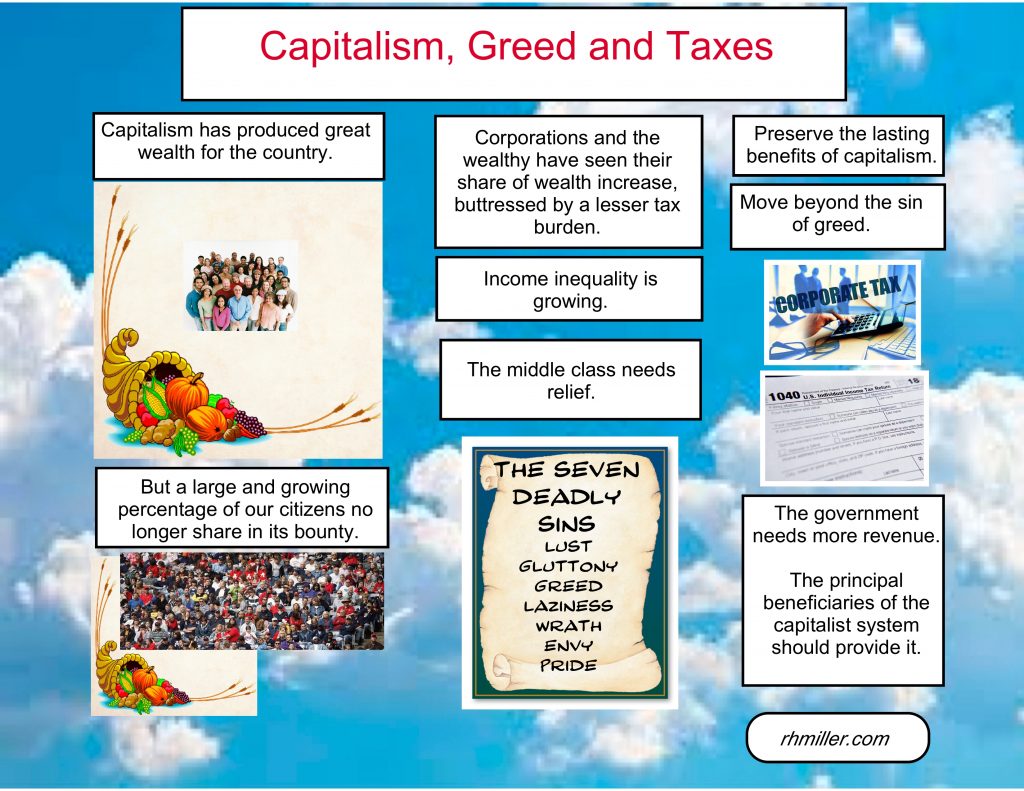

We live in a capitalist system that has produced great wealth for the country. But a large and growing percentage of our citizens no longer share in its bounty. The rising tide no longer lifts all boats. No, I’m not suggesting we dismantle the capitalist system, but we also can’t allow ourselves to be overcome by one of the seven deadly sins, greed. We all want the opportunity to prosper, but this excessive, unchecked accumulation of wealth is greed writ large, and threatens to destroy the good capitalism generates.

We must ask those who benefit most from the open society that allows capitalism to prosper to share more of its burden. In short, that means corporations and wealthy individuals should pay higher taxes. Conversely we must reduce the burden on the middle class and put more spendable income in its hands.

The Benefits of Capitalism

Winston Churchill expressed his views on capitalism saying, “The inherent vice of capitalism is the unequal sharing of blessings.” As for socialism, he added, “The inherent virtue of socialism is the equal sharing of miseries.”

Warren Buffet, fourth wealthiest person in the world, is the founder and CEO of Berkshire Hathaway. At the Company’s annual meeting in 2017 he acknowledged that characteristic of capitalism Churchill so aptly expressed. “I’m afraid a capitalist system will always hurt some people,” he told stockholders in attendance. But he did not say it defensively. At the current year’s annual meeting he proudly proclaimed, “I’m a card-carrying capitalist. I believe we wouldn’t be sitting here except for the market system.”

The Need for Greater Taxes on the Wealthy

Buffet strongly believes the capitalist system’s fundamental necessity to continually increase productivity is a driving force in economic growth. And the opportunity for individual success fosters creativity and ingenuity in new products and services. But he doesn’t believe in unchecked or unfettered capitalism. He recognizes the need for “rules” and the need to address the growing inequality in the U.S. economy. To that end, he makes a strong case for higher taxes on the wealthy.

Bill Gates, the second richest man in the world shares Buffet’s views on the benefits of capitalism, but also recognizes the need to address growing inequality. He too, believes there must be higher taxes on the wealthy.

Republican Views on Taxation

Obviously, the President and the Republican Party do not share that viewpoint. They told us the huge tax cut enacted in 2017 would greatly benefit the middle class. If true, that would begin to address the issue of inequality. But that was not and is not true. The bulk of those cuts went to corporations and the wealthy. Out of 5.9 million employers, only 413 gave the promised wage hikes or bonuses, benefiting just 4.3% of all workers.

But this isn’t a detailed critique of the Trump tax cuts, which have not and will not deliver as promised. Rather it focuses on the failure of those tax cuts to address growing inequality, and instead, actually exacerbate it.

In 2018 Republican Senator Marco Rubio observed that big businesses were not investing in their workers as Republicans had promised. “In fact,” he said, “they bought back shares, a few gave out bonuses; there’s no evidence whatsoever that the money’s been massively poured back into the American workers.”

Companies in the S&P 500 spent a record amount of $806 billion of their tax savings on stock buybacks in 2018. These buybacks tend to raise stock prices and thus benefit stockholders who are principally among the wealthiest.

Impact of the Trump 2017 Tax Cuts

While filling the coffers of the already wealthy, the Trump tax cuts have also added significantly to the U.S. deficit. Given the Republican narrative that deficits are caused by unrestrained spending, they will likely call for massive cuts in spending. Of course, those cuts will affect programs that benefit the poor and middle class, thereby widening the inequality gap.

Corporations and the wealthy have seen their share of wealth increase, buttressed by a lesser tax burden. And as if to emphasize that point, 60 corporations paid no federal income tax in 2018 despite earning billions of dollars in profit. That is unconscionable. If nothing else, it dramatizes the need for considerable change in our system of taxation.

Corporations and the Statutory Tax Rate

The statutory federal income tax rate on U.S. corporate profits was 35% before the 2017 Trump tax cuts. Corporations long complained that rate was too high compared to corporate taxes levied by other countries making the U.S. uncompetitive. But this was a disingenuous argument. Loopholes and opportunities to move profit to low or no tax jurisdictions made the effective tax rate much lower.

In 2017 the Institute on Taxation and Economic Policy issued a report, The 35 Percent Corporate Tax Myth. They studied 258 Fortune 500 companies that were consistently profitable in each of the eight years between 2008 and 2015. As a group they paid an effective federal income tax rate of 21.2%. Eighteen of the corporations paid no income tax at all during the eight-year period. Forty-eight paid an effective tax rate of 10% during that period. The Trump tax cuts reduced the statutory rate to 21%, which means the effective tax rate will now be substantially lower.

Infrastructure

Corporations benefit from the country’s infrastructure: educated employees, healthcare, roads, bridges, police protection. Yet they are not carrying their weight when it comes to sharing its costs. They take advantage of the opportunities provided by a capitalist economy and use all lawful means to avoid paying for them. Some would argue that minimizing taxes by lawful means is a perfectly acceptable practice. I totally agree. That is why it is necessary to change the law so that at the very least, corporations pay a fair tax to operate in the United States.

Make Believe Accounting and Changes in Tax Law

Corporations maximize profits in low or no tax jurisdictions through make believe accounting. They record or change normal transactions to realize tax savings, rather than economic or legal considerations. For example, they place a valuable patent in a low tax jurisdiction (Ireland), which then charges a royalty for its use in a high tax jurisdiction (United States). The result: higher profits in the low tax jurisdiction and lower profits in the high tax jurisdiction.

They use the same technique to price manufactured goods and transfer higher costs to high tax jurisdictions. So, the very first step is to require that the substance of all transactions must be based on economic or legal factors, not tax avoidance.

Here is a sampling of special tax provisions that should be eliminated:

All that do not reflect economic reality (tax loopholes) ;

Those that apply specifically to a particular corporation to lower its taxes—usually obtained by highly paid lobbyists;

Provisions that allow businesses such as those in commercial real estate to pass on to their heirs an asset’s appreciated value without that appreciation ever having been taxed.

This is not a comprehensive list of tax loopholes that do not reflect economic reality yet permeate the tax system. Rather it is to focus on the necessity to close all such special provisions unless there is an overriding real economic or security reason to maintain them.

Taxation Based on Actual Economic Profit

Virtually all businesses prepare annual financial statements. The Securities and Exchange Commission (SEC) requires publicly owned companies to file quarterly and annual reports of specific financial information. Most privately owned businesses of size provide similar information to their banks and/or insurance company. Such financial information includes an income statement that reflects the company’s “book” profit, certified by the company’s independent accountants.

Based on industry wide Generally Accepted Accounting Principles, book profit is, perhaps, as close as it gets to real economic profit. This differs significantly from taxable income reported to the IRS, principally because of special tax provisions described above. Since it is the reported book profit that generally drives the company’s progress, it is this number that should become the basis for taxation.

Accordingly, there should be an Alternative Minimum Tax on Corporations based on a percentage of the actual “book” profit of all its U.S. entities.

If all tax loopholes were eliminated the book profit and taxable profit would be approximately the same. But that is not realistic. So, the company’s tax bill should be the greater of the Alternative Minimum Tax or the tax as calculated with existing special provisions (deductions). Except for a real economic book loss, no corporation should walk away with a zero-tax bill.

Wealthy Taxpayers

Many wealthy individuals accumulate their vast wealth while earning very little in salary. Therefore, they are not subject to ordinary income tax rates. So, higher tax rates on the wealthy, alone, will not solve the problem of widening economic inequality. Nonetheless, those rates should be raised. Again, the issue of special provisions rears its head to allow wealthy taxpayers to shield their income from taxation.

Investments in real estate, stocks, art and other assets can appreciate until they are sold. However even in circumstances indicated above, certain appreciated assets can be passed on to heirs without being taxed. Special provisions such as accelerated depreciation or untaxed appreciation of asset values should be eliminated.

In the absence of their elimination, there should be a revision of the individual Alternative Minimum Tax for wealthy taxpayers. Deductions arising out of special provisions such as those described above should be added back to income to produce adjusted alternative taxable income. Then a percentage should be applied to that amount to produce an Adjusted Alternative Minimum Tax.

Just as with corporations, no individual should walk away with a zero-tax bill.

Capitalism and Taxes

No one likes to pay taxes. For 37 years, corporations and the wealthy have benefited greatly from reductions in taxes. At the same time the U.S. debt has reached astronomical levels while the country’s infrastructure has deteriorated. This is not sustainable.

Believing in capitalism and patriotism are not mutually exclusive. We should look to the example of such towering figures as Warren Buffet and Bill Gates. Both are card-carrying capitalists, but they are also patriots. Other fellow capitalists should heed their call to patriotism.

The government needs more revenue and we should ask the principal beneficiaries of the capitalist system to step forward and provide it.